Sourcing scrap metal from Africa offers significant commercial opportunity but requires disciplined management of technical, logistical, regulatory and other risks. Growing urbanization, expanding industry and large informal collection networks across the continent have increased volumes of both ferrous and non-ferrous scrap. Buyers must reconcile attractive pricing with variable quality, fragmented supply chains, and evolving policy frameworks.

Price Difference and Current Market Dynamics

Here are the referenced local collection prices for clean, baled UBC (used beverage cans), converted to USD:

- Nigeria: $1.79 / kg (source: reported domestic shipment data)

- USA: $1.96–$2.05 / kg (source: Fastmarkets domestic UBC quotes)

Note: These figures require validation against current market conditions. Global scrap prices increased 1.5-13% between December 2025 and February 13, 2026, which may narrow the cost advantage claimed here.

Countries and Market Maturity

Country maturity varies: Egypt and Morocco generally provide the most stable, export‑oriented material and processing capacity, while countries such as Ghana, Nigeria, Kenya and Tanzania supply substantial volumes often through less formal channels.

- Egypt offers a mix of formal and informal collection. Major cities have licensed recycling companies, authorized scrap yards and industrial off-takers.

- Morocco has a growing formal sector with licensed processors, consolidators and municipal recycling schemes. The country’s proximity to European markets has supported more organized scrap businesses and export-ready operations in key ports.

Other sources (Ghana, Nigeria, Kenya, Tanzania) supply substantial volumes often through less formal channels, but require careful regulatory compliance given tighter export controls and environmental permitting requirements in several countries.

Grades

Quality and grade variability pose core technical challenges.

- Ferrous material must be graded (HMS 1/2, shredded vs. unshredded) and checked for contaminants or tramp elements—copper and chromium in steel can undermine furnace yields and product quality.

- Non-ferrous scrap requires even more granular sorting: copper must be differentiated by temper and insulation removal, aluminium sorted by alloy family where possible, and brass and stainless identified accurately to prevent costly furnace contamination.

Formal recyclers and processors offer consistent quality, documentation and the capacity to prepare export-ready lots, making them preferable partners for buyers seeking reliability and compliance. The informal sector supplies enormous volumes at low cost but frequently lacks documentation; hazardous practices and child labor remain recurrent concerns.

Regulations: Critical Risk Factor

Regulatory fragmentation and evolving export controls represent a major source of transaction risk that has intensified in 2026. Certain countries are notably more difficult for exporters due to strict regulation, bureaucracy, poor logistics or insecurity:

- Nigeria and Ghana have seen tighter controls and frequent documentation scrutiny.

- Kenya and Tanzania require environmental permitting and can face port congestion.

- Ethiopia has restrictive licensing requirements.

- South Africa faces policy uncertainty that has undermined investor confidence and market stability.

- Politically unstable countries such as the DRC or Libya pose security and governance risks.

Buyers should conduct thorough due diligence on regulatory changes and policy frameworks before committing to supply arrangements.

Logistics

Logistics and export infrastructure add further complexity. Major ports like Durban, Cape Town, Alexandria, Casablanca, Tema, Lagos and Mombasa provide important gateways, but port efficiency and inland connectivity differ. Inland road quality and security on transit routes directly influence cost and delivery reliability.

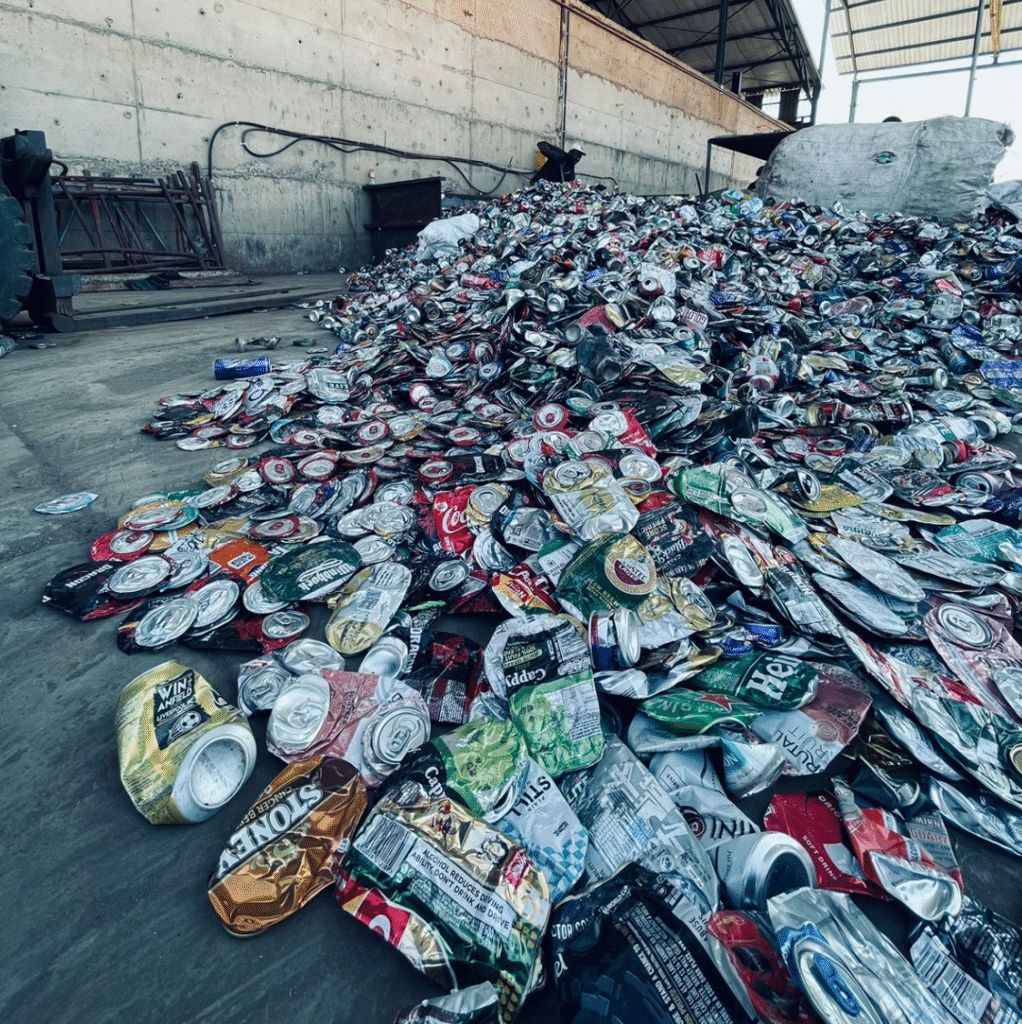

Proto credit: https://africascrap.co.za/

Example Calculations: Sourcing to GCC

Caveat: These calculations are illustrative and need to be evaluated. These also do not include quality control and do not price in risks. Recent price volatility may affect cost-effectiveness. Calculations assume stable regulatory environments.

USA, East Coast to GCC (example port: Jebel Ali)

- Local collection (clean baled UBC): $2.00 / kg

- Inland trucking to US port: $30 / t

- Export packing / terminal handling / docs: $50 / t

- Ocean freight (US East Coast to Jebel Ali, FCL-average): $160 / t

- Destination handling, customs, delivery in GCC: $40 / t

- Insurance & misc: $10 / t

- Estimated CFR to Jebel Ali: $2.29 / kg

Nigeria, Lagos to GCC (example port: Jebel Ali)

- Local collection (clean baled UBC): $1.79 / kg

- Inland trucking: $40 / t

- Export packing / yard / documentation: $60 / t

- Ocean freight Lagos to Jebel Ali, FCL-average: $180 / t

- Destination handling, customs, delivery in GCC: $40 / t

- Insurance & misc: $10 / t

- Estimated CFR to Jebel Ali: $2.12 / kg

Egypt, Alexandria to GCC (example port: Jebel Ali)

- Local collection (clean baled UBC): $1.60 / kg

- Inland trucking to port (Alexandria): $20 / t

- Export packing / yard / documentation: $50 / t

- Ocean freight (Alexandria to Jebel Ali, FCL-average): $120 / t

- Destination handling, customs, delivery in GCC: $40 / t

- Insurance & misc: $10 / t

- Estimated CFR to Jebel Ali: $1.84 / kg

Summary

With the right supplier country, reliable sourcing partners and robust systems in place, double-digit savings on sourced scrap can be realized—though cost advantages should be weighed against policy and regulatory risks, particularly in markets subject to sudden policy changes.

African metal scrap sourcing presents commercial opportunity amid intensifying market complexity. Global scrap prices increased 1.5-13% between late December 2025 and mid-February 2026 with the market projected to grow to $614 billion by 2034. New scrap sources like Africa will be need to be explored to support this growth projection.

Mining Metals and Materials Markets can help producers to evaluate scrap pools, available qualities, design the value optimising and risk minimising sourcing network with all risk management tools in place.