Scrap usage varies significantly across steel producers depending on furnace technology, product mix, and regional scrap availability:

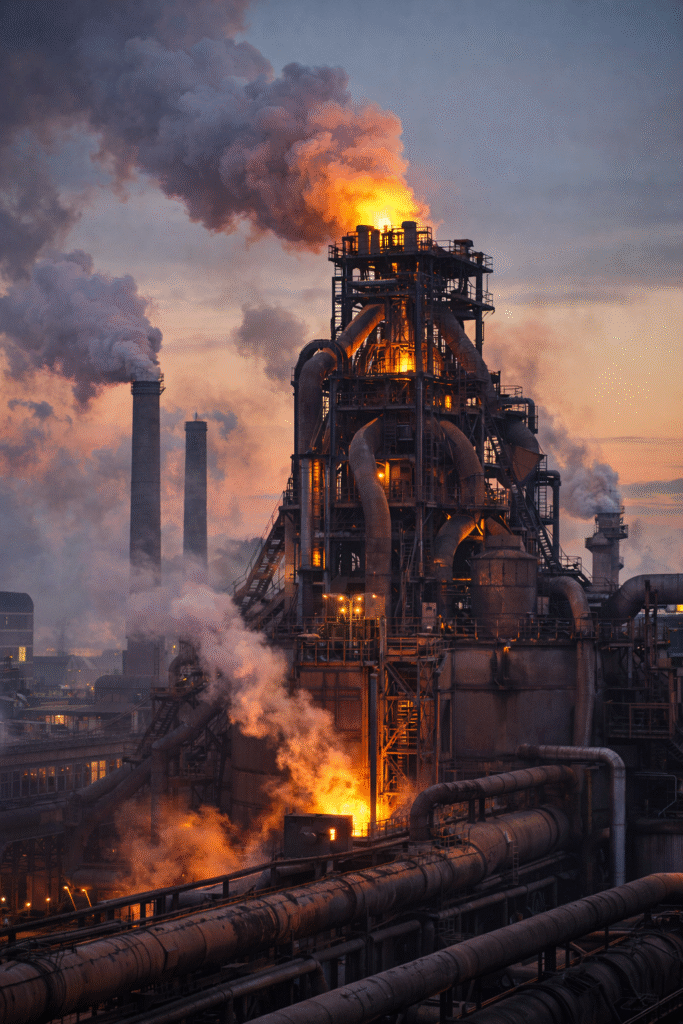

- Electric Arc Furnaces (EAFs) are inherently designed to melt scrap, while Blast Furnace–Basic Oxygen Furnace (BF-BOF) routes are structurally designed around iron ore and coke.

- Furthermore, long products such as rebar and sections tolerate higher scrap ratios, while automotive flat products and electrical steel require tight chemistry control and therefore tolerate lower scrap ratios.

- Regions with abundant clean, industrial scrap can achieve higher effective scrap utilisation than regions that rely on imported or lower-quality scrap.

Despite these constraints, the carbon intensity gap between EAF and BF-BOF production is material. EAF-produced steel typically emits 60–85% less CO₂ than BF-BOF steel, depending on the electricity mix.

Under full CBAM costing, this translates into approximately €80–€120 savings per tonne of steel in avoided CBAM charges at current carbon prices. At prevailing EU steel prices, this corresponds to a very high 10–20% cost difference of the delivered steel when exporting into the EU.

This situation creates direct economic pressure on legacy BF-BOF producers. At the same time, the EU cannot eliminate steel imports. Structural deficits remain in flat steel for automotive and appliance applications, and semi-finished slab imports are still required for EU re-rollers. CBAM therefore reshapes trade flows rather than stopping them outright.

Although CBAM is still ramping up, over the implementation period from 2026 to 2035, different trends are likely. More EAF capacity will be built outside the EU to remain competitive under CBAM, increasing global demand for scrap. Within the EU, demand for scrap will also rise as producers seek to reduce EU ETS exposure, lower energy and carbon costs, and protect margins.

These dynamics require a fundamental rethink of ferrous scrap sourcing strategy by steel producers.

- Producers need to move from spot buying to controlled access through long-term scrap offtake agreements, vertical integration, or ownership of scrap processing.

- Investment in process and furnace technologies is needed that allow legacy BF-BOF operations to safely absorb higher scrap ratios.

- New scrap supply pools need to be explored and developed, particularly in MENA, Turkey, and parts of Africa, where collection and processing infrastructure remains underdeveloped.

- Scrap needs to be treated as a strategic raw material, similar to iron ore, with active price hedging, strategic stockpiling, and contractual securitisation of supply.

CBAM transforms scrap from a marginal input into a strategic lever for decarbonisation and competitiveness. Legacy producers that fail to secure scrap access are likely to face structural cost disadvantages rather than temporary margin pressure.

How can MM Markets support your business?

MM Markets helps companies design and implement resilient ferrous scrap sourcing strategies in a tightening, CBAM-driven market.

We support clients by:

- Identifying and assessing existing and emerging scrap supply pools, including market size, growth potential, regulatory constraints, logistics, and risk.

- Developing practical sourcing strategies based on volume, quality requirements, and sourcing models such as industrial scrap, post-consumer scrap, closed-loop systems, and long-term offtake.

- Screening and pre-qualifying scrap suppliers in priority regions.

- Assessing supply, regulatory, and counterparty risks for shortlisted suppliers.

- Supporting the structuring of commercial terms and region- and company-specific supply agreements.