Tariff policy uncertainty did not culminate in August 2025 but persisted at historically elevated levels throughout late 2025 and into early 2026, despite widespread media narratives. The apparent decline in Trade Policy Uncertainty indices from April’s record peaks masks a critical distinction: uncertainty fell from unprecedented heights but remained structurally abnormal compared to pre-2025 baselines, sustained by ongoing legal challenges, protracted bilateral negotiations, discretionary national security mechanisms, and supply chain dynamics that extend business uncertainty across quarters rather than resolving in a single event.

The August Implementation Did Not Resolve Underlying Uncertainty

While August 7, 2025 marked the implementation of reciprocal tariffs following a 90-day negotiation period, this date did not constitute an uncertainty peak because it created new sources of policy risk rather than resolving existing ones.

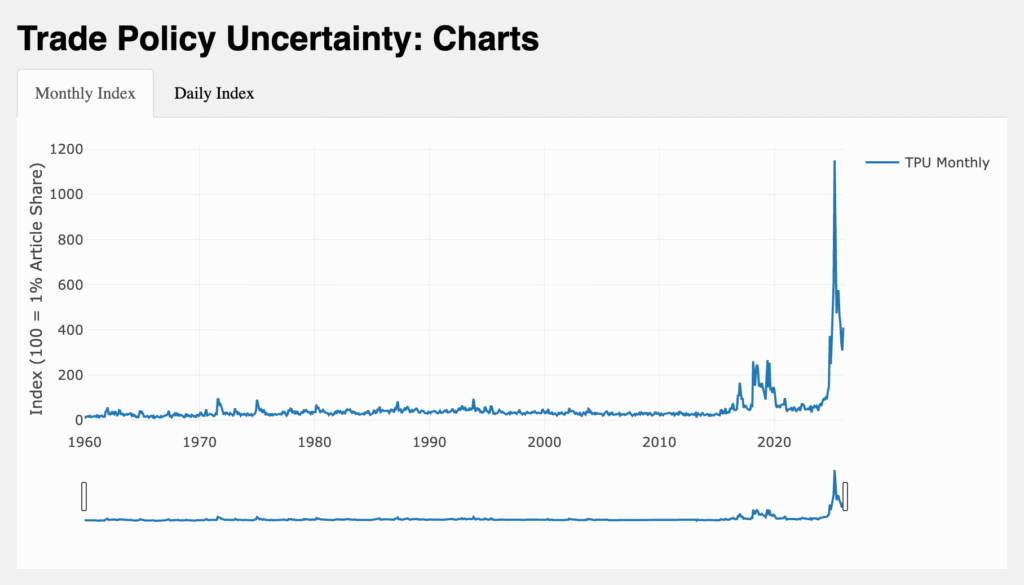

The OECD/Federal Reserve Trade Policy Uncertainty index showed a decline from April’s historic peak of 1,151.36 but remained substantially elevated through late 2025, remaining approximately 250 points above its four-year average according to Eurochambres analysis.

Source: https://www.matteoiacoviello.com/tpu.htm

This distinction between declining from peaks and remaining historically abnormal is critical: elevated baseline uncertainty levels warrant strategic risk management even when they represent moderation from crisis levels. Academic research examining stock-bond correlations and TPU through mid-2025 found clear patterns of elevated uncertainty clustering throughout 2025, with a positive trend in TPU persisting across the entire year rather than concentrating in any single month.

The World Trade Organization warned that tariff-driven uncertainty would cut world merchandise trade growth to 2.4 percent in 2025 but fall negative to minus 0.5 percent in 2026, suggesting institutional expectations that tariff effects would deepen rather than resolve after August implementation.

Prolonged Uncertainty

- Bilateral negotiations that extended from August through February 2026 created rolling episodes of policy uncertainty rather than resolving it. Malaysia concluded negotiations by August 1, but implementation details were not finalized until December 2025, maintaining ambiguity about effective tariff rates. Thailand achieved a preliminary agreement explicitly characterized as non-binding and “requiring further negotiations.” India reached a framework agreement in February 2026 with further negotiations to follow. This sequential pattern meant that from August 2025 through early 2026, questions about which countries had secured exemptions and what final tariff rates applied remained partially unresolved, sustaining uncertainty across the entire period.

- Legal vulnerability from IEEPA-based tariffs remained unresolved until potentially February 2026’s Supreme Court decision, vulnerabilities.

- National security discretion enabled dynamic tariff regimes subject to modification based on executive reinterpretation: the Trump administration imposed 25 percent secondary tariffs on Russian oil purchased by India as a national security measure, then withdrew them in February 2026 after India committed to purchasing restrictions, demonstrating how national security justifications create enduring policy uncertainty.

- Supply chain reallocation created path dependencies extending tariff effects across quarters; Cato Institute research found that US importers significantly redirected purchases during the April-July uncertainty period, creating switching costs and new supplier relationships that remained locked in through late 2025.

Conclusion

August 2025 marked a notable institutional event but not an uncertainty peak. Legal processes, protracted bilateral negotiations, discretionary national security mechanisms, and embedded supply chain reconfigurations all extended policy uncertainty across extended horizons. Institutional forecasts from the WTO, OECD, and S&P Global collectively anticipated that elevated uncertainty would persist through 2026, confirming that tariff-driven risk should be managed as a sustained strategic challenge rather than a time-bounded shock.