Firstly, importers need to identify the minimum inputs

For each product from each supplier, importers must identify:

- Imported quantity – tonnes of product imported

- Embedded emissions intensity – tonnes of CO₂ per tonne of product (tCO₂/t), based on verified supplier data

- EU ETS carbon price – € per tonne of CO₂ (typically an average price over the relevant period)

- Carbon price already paid abroad (if any) – € per tonne of CO₂ (only deductible if verifiable and CBAM-eligible)

Simplified Core Formula

CBAM Carbon Cost = Imported quantity (t) × Embedded emissions (tCO₂/t) × (EU ETS price − eligible foreign carbon price)

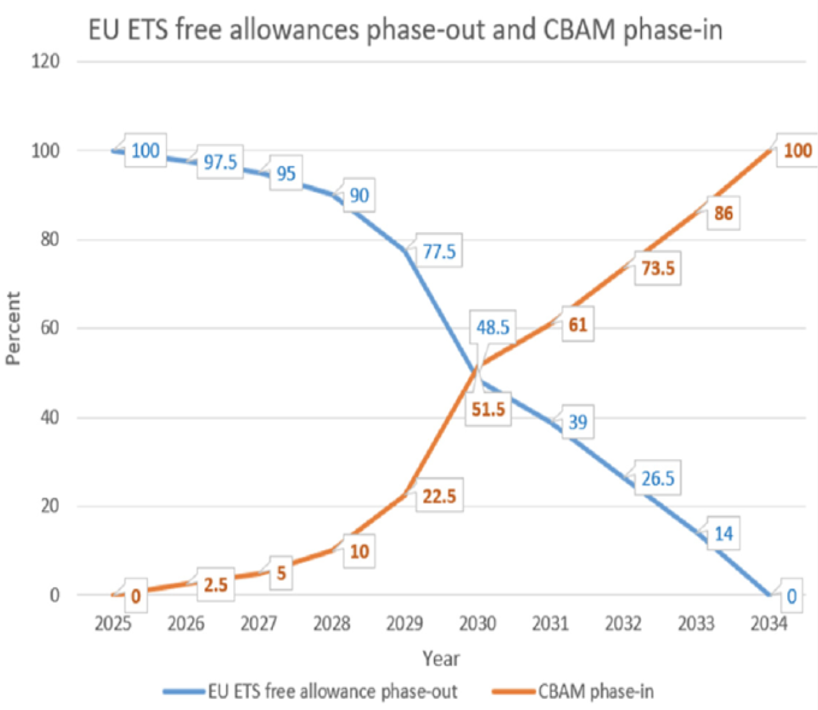

From 2026 to 2034, CBAM is phased in. In early years, importers only pay for an increasing percentage of embedded emissions (mirroring the phase-out of EU ETS free allowances).

Source of Graph: European Commission CBAM Regulation and EU ETS reform policy framework and associated analysis (e.g., PWC, Climate Action documentation

The examples below show the full-exposure cost for simplicity and comparability.

Example 1: Steel supplier:

- Product: Hot-rolled steel

- Supplier: Supplier A (non-EU)

- Quantity imported: 1,000 tonnes

- Emissions intensity: 2.2 tCO₂ / tonne

- EU ETS price: €80 / tCO₂

- Foreign carbon price paid: €0

Calculation for 1000 t: 1,000 × 2.2 × 80 = €176,000 CBAM cost

Carbon cost per tonne of product: €176 / tonne

Example 2: Aluminium supplier (with foreign carbon price)

- Product: Primary aluminium

- Quantity: 500 tonnes

- Emissions intensity: 8.0 tCO₂ / tonne

- EU ETS price: €80 / tCO₂

- Carbon tax paid abroad: €20 / tCO₂

Net carbon price: 80 − 20 = €60 / tCO₂

Calculation for 500 tonnes: 500 × 8.0 × 60 = €240,000 CBAM cost

Carbon cost per tonne: €480 / tonne

Example 3: Using EU default values if a supplier provides no usable data

If a supplier provides no usable data, the EU applies default values

Example for steel

Default emissions intensity for steel: 2.9 tCO₂ / tonne

1,000 × 2.9 × 80 = €232,000

Penalty for poor data per tonne: €56 / tonne extra cost.

How MM Markets Can Support

MM Markets supports companies with CBAM readiness through:

- Data requirement mapping (per product, per supplier): CN-code scope, required metrics, and methodology alignment.

- Supplier data packs: submission templates aligned with EU requirements + evidence checklists.

- Supplier action plans: escalation pathways where suppliers can’t deliver compliant data on time.

- Data validation: calculation checks, methodology reviews, and benchmark sanity checks.

- Verification readiness: pre-verification review, data cleaning, and audit prep for accredited third-party verification in the definitive regime.

- Cost modelling & supplier impact assessment:

- Carbon cost per supplier

- Supplier emission comparison

- Savings from switching suppliers

- Long-term exposure forecasting.