Given the typical economic life of data centres, the contraction of on-premise enterprise facilities and the current age of the global data centre fleet, an estimated 4–6% of capacity undergoes decommissioning or major refurbishment each year. This steady turnover represents a meaningful recycling opportunity: legacy electrical and mechanical systems contain substantial copper and aluminium that can be recovered and fed back into the supply chain.

Although recycling will not offset the surge in primary demand from new construction, it does create a growing secondary source of both metals and a pathway to reduce the sector’s overall material footprint.

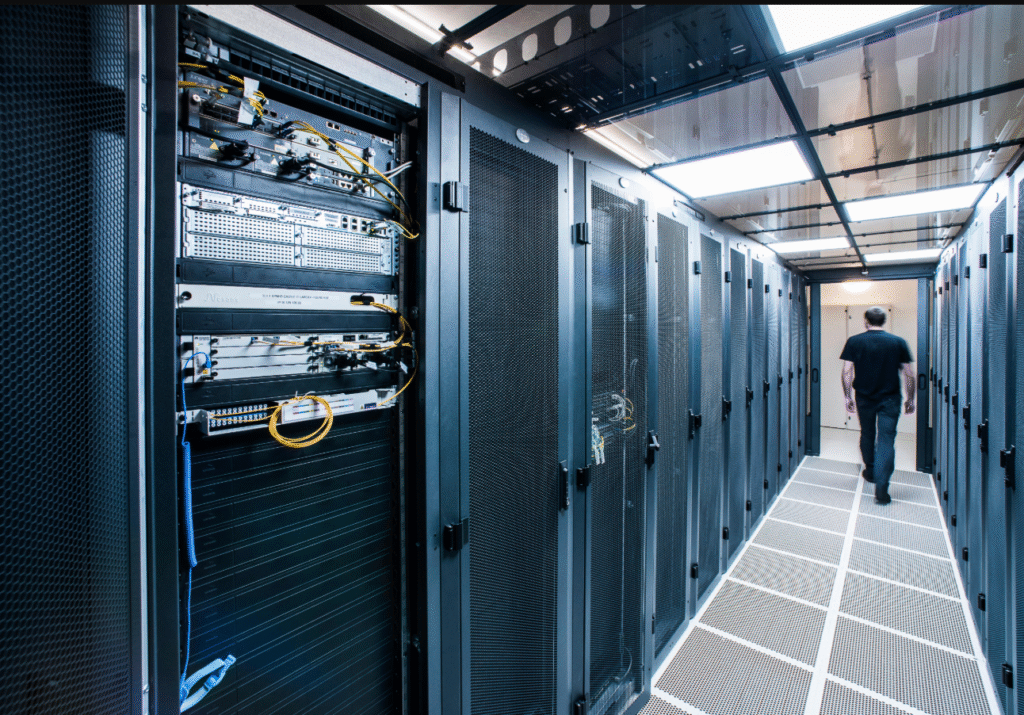

A High-Value Urban Mine Despite Modest Volumes

Taking into account the copper stock embedded in legacy data centres, along with estimated annual retirement and recovery rates (sources: EDEAS/RePEc, Circular Economy Platform and other studies), MM Markets assesses the current recycling potential at 15–20 kilotons per year, with a total available stock of roughly 0.5 megatons.

Although this is modest compared with global copper mine production (~22 megatons per year), it is strategically significant from a circularity and security-of-supply perspective. The material originates from an urban mine stream, is highly concentrated in OECD economies, and consists largely of high-purity electrical copper.

Urban Mining vs Primary Mining: Different Economics, Different Advantages

Although urban-mined copper volumes are modest compared with primary production, the economic and environmental performance is markedly superior.

Crucially, recycled copper retains full metallurgical and electrical quality, making it functionally identical to primary copper. These characteristics make copper recovered from legacy data-centre decommissioning—an OECD-concentrated, high-purity urban mine stream—a strategically valuable complement to conventional mining despite its relatively small scale.

Producing refined copper from ore typically requires 32–100 GJ of energy per tonne, whereas recycling uses only 10–20% of that, delivering ~80–85% energy savings.

The carbon footprint shows an even starker contrast: primary copper averages around 4.6 t CO₂e per tonne, while recycling reduces emissions by 70–95%, depending on the waste process. (Sources: Zeng, X. et al. (2022), “Comparing the costs and benefits of virgin and urban mining,” Frontiers in Sustainable Cities; International Copper Association (ICA), “Copper Recycling – Resource Library.”)

Cost studies also suggest that urban-mined copper can be US$ 3,000 per tonne cheaper than virgin metal, with production costs roughly 50% lower.

MM Market on data centres

Understanding these dynamics—construction trends, cooling technologies, upstream power-system effects and recycling flows—is essential for anticipating how AI-driven digital infrastructure will shape global copper and aluminium demand. We support clients across these areas with data-driven analysis, scenario modelling and market insight.

Picture: datacenterknowledge.com