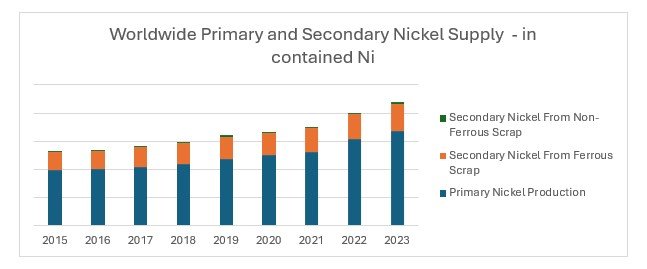

Indonesia is the engine of nickel supply. Production there has been ramping up fast, and that primary metal has set the pace in today’s nickel market. However, stainless-steel recycling is slowly influencing the market balance. Every month, scrap yards feed the stainless-steel mills with secondary nickel formed from stainless steel scrap. The nickel units add to the overall nickel supply from mines, improve the market balance—and often move the price. The impact is even more relevant in regional scrap pools like the US, Japan and EU.

Why do mills use scrap? Money first. For common 304 stainless steel grades, mills typically pay around 55–70% of the LME price for the nickel contained in stainless scrap. Nickel pig iron (NPI) often lands at roughly 70–80% of LME on a nickel-unit basis. In normal markets, that makes scrap roughly 10–25% cheaper per nickel unit.

Carbon matters too. Scrap-heavy melts carry far less embodied CO₂ than primary-heavy routes. Using Worldstainless’s cradle-to-gate model: a melt with a high 85% scrap has 1.95 tCO₂/t for the final product, while a low 30% scrap-based melt leads to 6.8 tCO₂/t for the final product. This is a significant difference in the carbon footprint of the stainless steel produced, and with the introduction of CBAM and similar systems, the drive to use scrap as opposed to virgin class 1 or 2 nickel will increase in the future.

Location shapes everything. The deepest, most reliable scrap pools are in North America, Europe, and Japan, where collection and sorting are mature. China’s pool is growing as its installed stock ages. Indonesia and much of Southeast Asia remain scrap-short, so they lean harder on primary units.

Using stainless steel scrap isn’t magic. Contamination limits how much scrap some melt mixes can take, and export rules can choke scrap flows. However, while Indonesia sets the baseline, stainless-steel recycling is becoming an increasingly important factor for the nickel supply-demand balance. When spreads favour scrap and carbon costs bite, the mills with access to clean, well-sorted scrap—and the ability to push higher scrap ratios—will win.