MM Markets 2025 Copper Substitution Report is based on an extensive international survey of copper and aluminium buyers and users. Speaking to a wide range of survey participants enables the best feedback on trends happening now, and trends in the near future. Detailed feedback enables us to precisely update our existing datasets and indicators. Focused on price, the following bullets are extracted from initial survey and data work in the 2025 Copper Substitution Report:

-

- In today’s business environment, the decision to substitute tends to require a life-time calculation approach. Where new technologies arrive and deliver improved performance, calculations of price-value are revised.

-

- For most buyers/users, it makes sense to first investigate the absolute and relative material costs.

-

- Survey respondents said that material price is mainly driven by macroeconomic factors. Energy transition is the long-term price driver.

-

- 2024 was a year of political and financial insecurities however Q4 brought some material economic assurances, in some geographic regions.

-

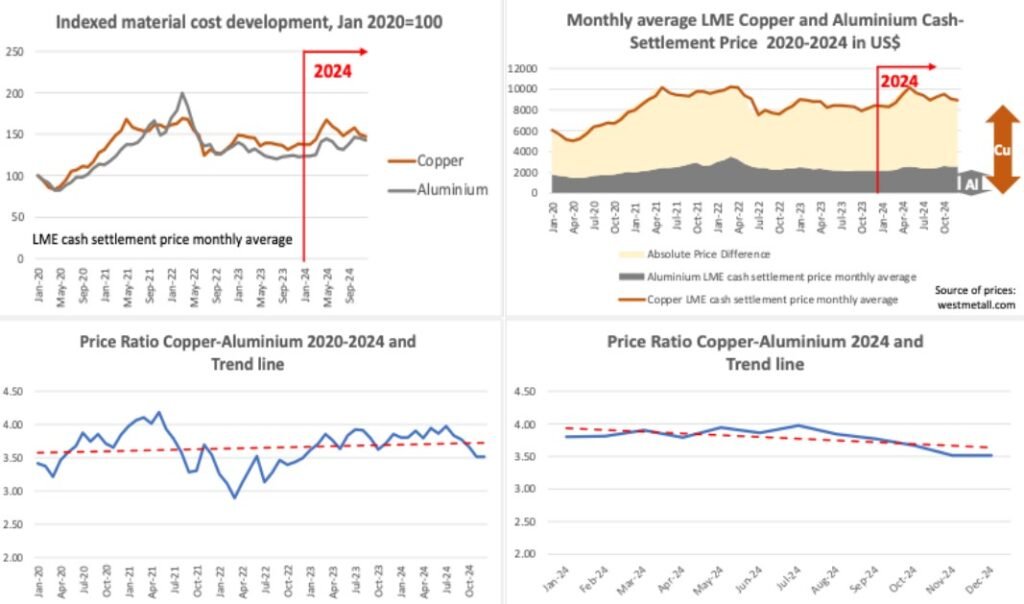

- Comparing development of the average LME cash settlement prices for copper and aluminium, both developed reasonably parallel.

-

- Reflecting on the increased material/gauge requirements for aluminium in electrical applications, requirements in order to achieve similar performance, copper is still relatively more expensive.

-

- Historic price development for both copper and aluminium highlights the absolute price difference but also the fact that copper price is relatively more volatile. Price volatility is a key factor when designing products and it adds risks to calculating returns.

-

- A tracking factor for material decision makers/procurement is development of the price ratio between copper and aluminium. The ratio can be seen as a motivator to reconsider material use.

-

- From 2020 to 2024, the price ratio moved between 2.9 and 4.2, overall indicating a slight upward trend over the period.

-

- There are applications where increased performance requirements lead buyers and users back to copper. For example, renewable energy farms (wind and solar), increasing in size, require conductors of a larger diameter and at the same time electrical losses need to me minimized.

MM Markets is working in the field of materials substitution. For the full picture, we are able to offer full (drivers, factors and detailed datasets) and bespoke analysis. A basic overview report is also available. Please do contact us for more details!

Please do contact colin.bennett@mm-markets.com or krisztina.kalman@mm-markets.com