The global nickel market is currently in a state of significant oversupply, largely driven by Indonesia’s emergence as the world’s top producer. Leveraging vertically integrated production systems, Indonesia has been able to supply nickel at low costs, reshaping the global supply landscape.

In April 2025, the United States launched a Section 232 investigation into nickel imports, citing national security concerns. Since then, market conditions have become increasingly volatile, as the U.S. considers new tariff measures that could potentially include both Class 1 and Class 2 nickel products.

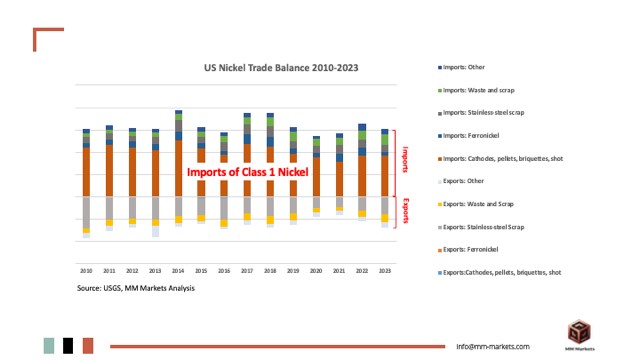

The U.S. has long maintained a structural trade deficit in nickel, consistently importing more nickel products than it exports. Imports are dominated by Class 1 nickel—primarily sourced from Canada. The trade deficit and nickel’s classification as a strategic raw material could trigger import duties with broad implications for downstream industries.

Nickel’s strategic importance is clear: it is essential for lithium-ion battery cathodes used in electric vehicles, grid-scale energy storage, and renewable power systems.

Beyond energy, high-performance nickel alloys are critical for military and aerospace technologies, including jet engines, submarines, and armour systems—thanks to their strength, corrosion resistance, and thermal stability.

Given the U.S.’s reliance on imported nickel and the rising risk of geopolitical disruptions or export controls, the domestic policy response is becoming increasingly assertive.

MM Markets (mm-markets.com) has developed deep expertise in the global nickel sector, including the evolving impact of U.S. trade policies and tariff regimes. This insight positions MM Markets to support clients navigating the uncertainties in this strategically vital material market.