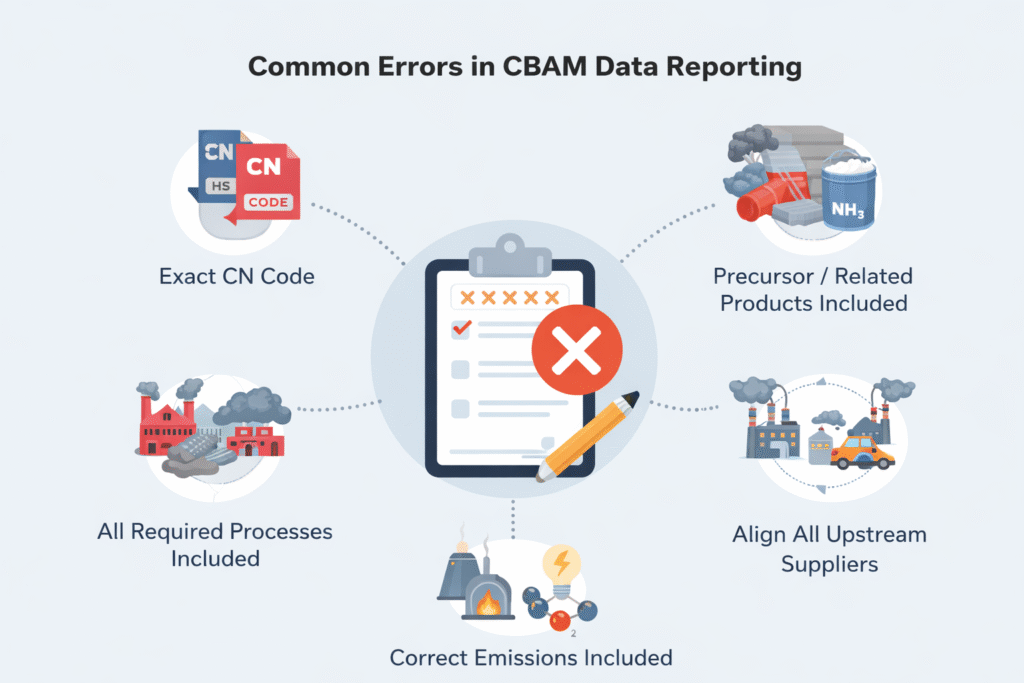

1. Use the Exact CN Code (Not the HS Code)

A recurring mistake is assuming that the HS code and CN code are interchangeable.

They are not.

- HS Code is a Global system, a code with 6 digits, defined by the World Customs Organization.

- CN Code is a more detailed EU-specific extension of HS, 8 digits, required for customs declarations and CBAM applicability.

2. Understand Precursor & Related Products Included in CBAM

CBAM does not apply only to finished materials. It also covers specific upstream intermediates (“precursors”) that carry significant embedded emissions and are essential to the production of CBAM goods. These precursors are CBAM goods in their own right when imported. Examples include:

Iron & Steel Precursors

- Iron ore pellets and agglomerates

- Direct reduced iron (DRI)

- Hot briquetted iron (HBI)

- Ferrous waste and scrap (selected categories)

- Semi-finished steel products: slabs, blooms, billets

- Sinter and pellet feed (where included under the relevant CN codes)

Aluminium Precursors

- Alumina (aluminium oxide)

- Prebaked carbon anodes for electrolysis

- Aluminium powders and flakes

- Unwrought aluminium (primary, alloyed, remelted forms)

Fertiliser Precursors

- Ammonia (NH₃)

- Nitric acid (HNO₃)

- Urea

- Ammonium nitrate

- Calcium ammonium nitrate

- NPK/NP/NPK variants covered under CBAM CN codes

Cement & Clinker Precursors

- Clinker

- Cement mixtures falling under CBAM CN codes

- White clinker

3. Ensure All Required Processes Are Included in the CBAM Calculation

CBAM uses cradle-to-gate approach up to the point of export, including:

- Raw material extraction

- Concentration

- Smelting or primary production

- Casting, rolling, forming, finishing

- On-site energy use and process emissions

- Packing and movement to the port of export

Process maps often become complex, and mis-scoping is a major source of incorrect emissions declarations.

4. Align All Upstream Suppliers

Every supplier contributing to a CBAM-covered product must:

- Calculate emissions for their specific process step,

- Provide evidence acceptable under CBAM rules,

- Report using CBAM-standardised data formats,

- Use product-level data, not corporate averages.

If only one supplier provides incomplete or non-compliant data, the importer must use EU default values, which are typically higher and increase CBAM costs.

5. Include the Correct Emissions in the CBAM Calculation

A. Direct Emissions (Mandatory for All Sectors)

- Fuel combustion emissions

- Natural gas in furnaces/kilns

- Coke in blast furnaces

- Diesel for on-site equipment

- Process emissions from chemical or physical transformations

- Cement: Calcination of limestone

- Steel: Reduction of iron ore, sintering, pelletising

- Aluminium: Anode consumption, PFC emissions from anode effects

- Fertilisers: Steam reforming, ammonia synthesis, nitric acid production

- Input-driven emissions

Emissions from carbon-containing inputs consumed or oxidised during production, even when not burned as fuel.

Examples:- Steel: Coke/coal as reductants; carbon electrodes

- Aluminium: Carbon anodes in Hall–Héroult cells

- Fertilisers: Carbon-containing precursors in nitric acid or ammonia synthesis

- Cement/Lime: Additives that decompose chemically

B. Indirect Emissions from Electricity for selected sectors

These include emissions associated with purchased electricity used during production.

Mandatory only for:

- Aluminium

- Hydrogen

- Electricity as a product

Sectors where indirect emissions are currently excluded:

- Iron & Steel

- Cement

- Fertilisers

However, the EU intends to extend CBAM to include electricity-related emissions for all sectors in later phases.