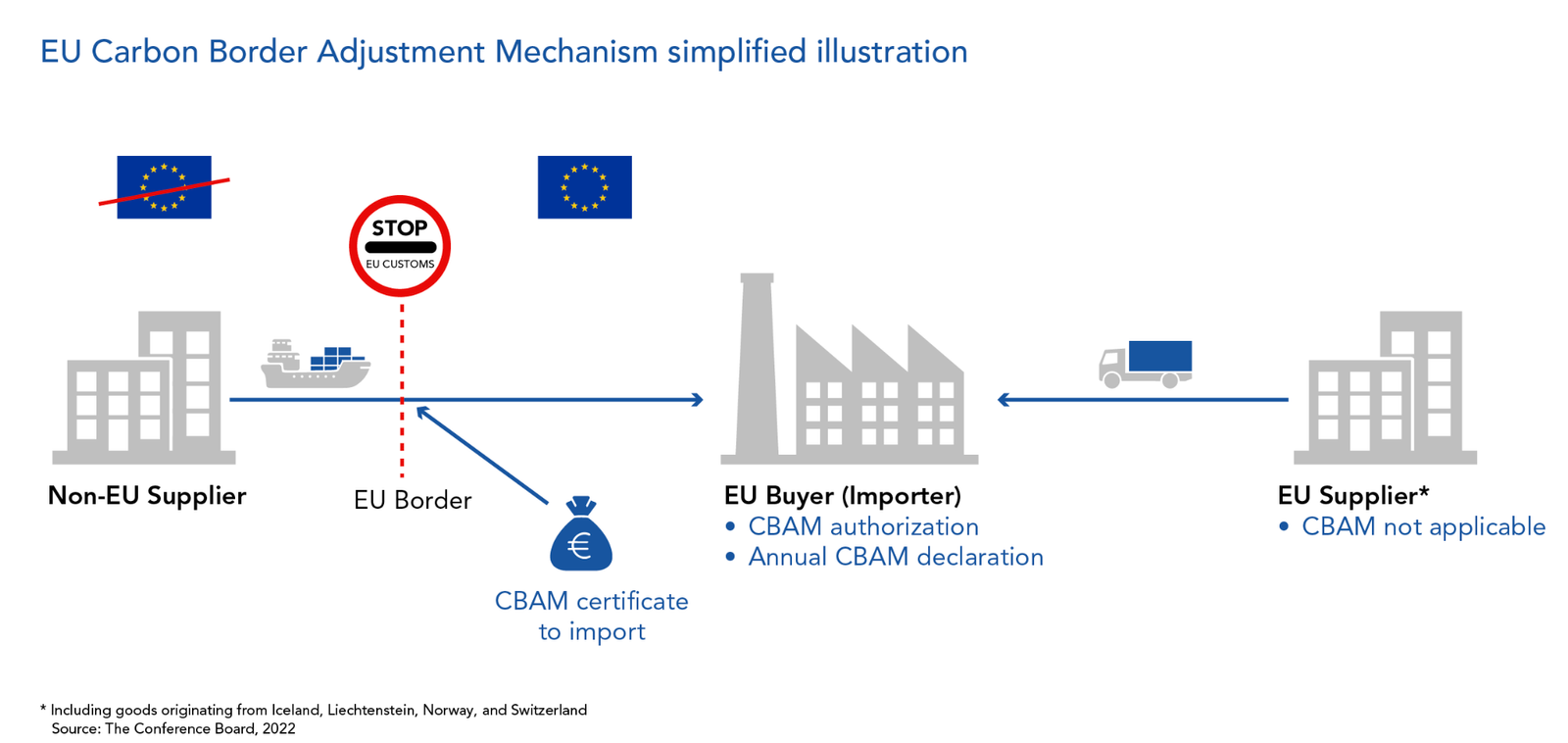

From 2026 onwards, EU importers of a list of goods will be impacted by the EU Carbon Border Adjustment Mechanism (CBAM).

CBAM is the EU’s mechanism for applying a carbon cost to imports, so non-EU producers do not gain an unfair advantage over EU companies that pay for emissions under the EU Emissions Trading System (EU ETS). Between 2023 and 2025, CBAM is in a transitional phase: importers must report embedded emissions, with no payment implications.

From 1 January 2026, the definitive CBAM regime begins, and the obligation to have authorised declarant status and report/surrender certificates begins on 1 January 2026. The actual sale of CBAM certificates to importers have been postponed to 1 February 2027. Importers will purchase certificates in 2027 retrospectively to cover emissions from goods imported in 2026, therefore, carbon emissions in 2026 still have financial implications.

Products Covered by CBAM

CBAM initially applies to imports in these categories:

- Iron & steel

- Aluminium

- Cement

- Fertilisers

- Electricity

- Hydrogen

- Certain precursor / some related products

Even if your products are not currently listed, CBAM is widely expected to expand over time to protect EU industry and reduce carbon leakage of downstream products and additional carbon-intensive sectors.

Implications for EU Importers

Importers need:

- Reliable emissions data. If you cannot provide compliant data, default values may be applied—often increasing the payment.

- Authorised CBAM declarant status/account. Importers need to apply for authorised declarant status for the definitive regime.

- Internal processes for:

- Carbon footprint data collection and verification

- Quarterly reporting

- Certificate planning, purchasing and reconciliation

- Supplier engagement and training. Supplier data is an essential input to CBAM reporting. Suppliers often need guidance on what to calculate, how, and what evidence to retain.

- Reduction of exposure via selective sourcing and operations to reduce exposure, including:

- Cleaner production methods

- Requiring verified emissions data

- Switching suppliers

How MM Markets Can Support

MM Markets supports companies with CBAM readiness through:

- Data requirement mapping (per product, per supplier): CN-code scope, required metrics, and methodology alignment.

- Supplier data packs: submission templates aligned with EU requirements + evidence checklists.

- Supplier action plans: escalation pathways where suppliers can’t deliver compliant data on time.

- Data validation: calculation checks, methodology reviews, and benchmark sanity checks.

- Verification readiness: pre-verification review, data cleaning, and audit prep for accredited third-party verification in the definitive regime.

- Cost modelling & supplier impact assessment:

- Carbon cost per supplierSupplier emission comparisonSavings from switching suppliers

- Long-term exposure forecasting.