For decades, supplier selection in the steel industry has followed familiar factors: price, quality, delivery, and reliability.

The introduction of the EU Carbon Border Adjustment Mechanism (CBAM), and similar emerging frameworks elsewhere changes this logic. CBAM does not introduce a new sustainability metric; it converts carbon exposure into a monetised and tradable cost for companies selling into the EU market.

CBAM exposure for exporters does not depend solely on their own production process, but also on the carbon footprint of their upstream suppliers. CBAM costs are an aggregation of emissions embedded in inputs sourced from multiple suppliers, rather than a single, fully controllable source.

Steel rolling mills provide a clear example. A re-roller importing slab from different blast furnace producers may purchase nominally identical material, yet face materially different CBAM liabilities depending on the carbon intensity of each slab supplier and the quality of emissions data provided. A rolling mill sourcing slab from a high-emissions blast furnace producer with weak emissions monitoring may be subject to default CBAM values and significantly higher carbon costs than a competitor sourcing from a lower-emissions producer or an EAF-based slab supplier. The same logic applies to billet, hot-rolled coil, and other semi-finished inputs.

Cost calculation for a flat rolling mill sourcing slab

Typical embedded emissions (illustrative ranges):

- BF-BOF slab: 1.9–2.4 tCO₂ per tonne

- DRI-EAF slab (gas-based): 0.5–0.9 tCO₂ per tonne

- Scrap-EAF slab (renewable power): 0.2–0.6 tCO₂ per tonne

Assumptions: carbon price of €80 per tCO₂ and a yield factor of 1.05.

Example 1: comparing a BF-BOF supplier with a gas-based DRI-EAF supplier

BF-BOF slab at 2.2 tCO₂ per tonne versus DRI-EAF slab at 0.7 tCO₂ per tonne

Difference: 2.2 − 0.7 = 1.5 tCO₂ per tonne of slab

CBAM cost difference: 1.5 × 80 × 1.05 = approximately €126 per tonne of finished steel

Example 2: comparing a BF-BOF supplier with a scrap-based EAF supplier using renewables

BF-BOF slab at 2.2 tCO₂ per tonne versus scrap-EAF slab at 0.4 tCO₂ per tonne

Difference: 1.8 tCO₂ per tonne of slab

CBAM cost difference: 1.8 × 80 × 1.05 = approximately €151 per tonne of finished steel

For slab-based rolling, differences between upstream suppliers commonly translate into CBAM-driven cost gaps of around €100–€160 per tonne of finished steel at a carbon price of €80 per tCO₂.

Consequences of cost differences between suppliers

As a result of these significant cost differentials, CBAM exposure for exporters becomes a supply-chain optimisation problem. Mills that actively manage supplier portfolios by shifting some volumes toward lower-carbon upstream producers can materially reduce CBAM costs without changing their own assets.

More importantly, CBAM introduces a time dimension into supplier selection. Carbon prices are expected to rise, free allowances are being phased out, and default emission values significantly penalise suppliers with poor data. A supplier that appears competitive today may become structurally uncompetitive over the life of a multi-year contract.

In this context, the supplier’s future capability becomes as important as current performance. The ability to provide audited emissions data, adapt production routes, increase scrap use, or invest in lower-carbon technologies becomes a core selection criterion. Supplier trajectories matter as much as current carbon footprints.

Reassessing supplier networks

One consequence of CBAM integration is that it forces companies to reassess existing suppliers and compare them objectively with alternative suppliers.

Suppliers with higher nominal prices, often EAF-based or gas-DRI producers, may emerge as lower-risk and lower-cost partners once CBAM is fully applied. A CBAM-integrated framework makes these trade-offs visible, quantifiable, and resilient.

This comparison is not about switching suppliers overnight. It is about informing volume allocation, contract duration, and renewal decisions with a realistic assessment of future cost exposure.

Strategic consequences for steel buyers

Over time, CBAM-integrated supplier selection is likely to reshape steel supply chains in several ways.

First, supplier portfolios will become more segmented. Buyers will increasingly differentiate between low-carbon strategic suppliers, transitional suppliers with credible improvement pathways, and high-risk suppliers suitable only for short-term engagement or non-EU markets.

Second, contract structures will evolve. Longer-term agreements will increasingly be reserved for suppliers with lower and declining CBAM exposure, while higher-carbon suppliers face shorter contract terms, reduced volumes, or price re-openers linked to carbon costs.

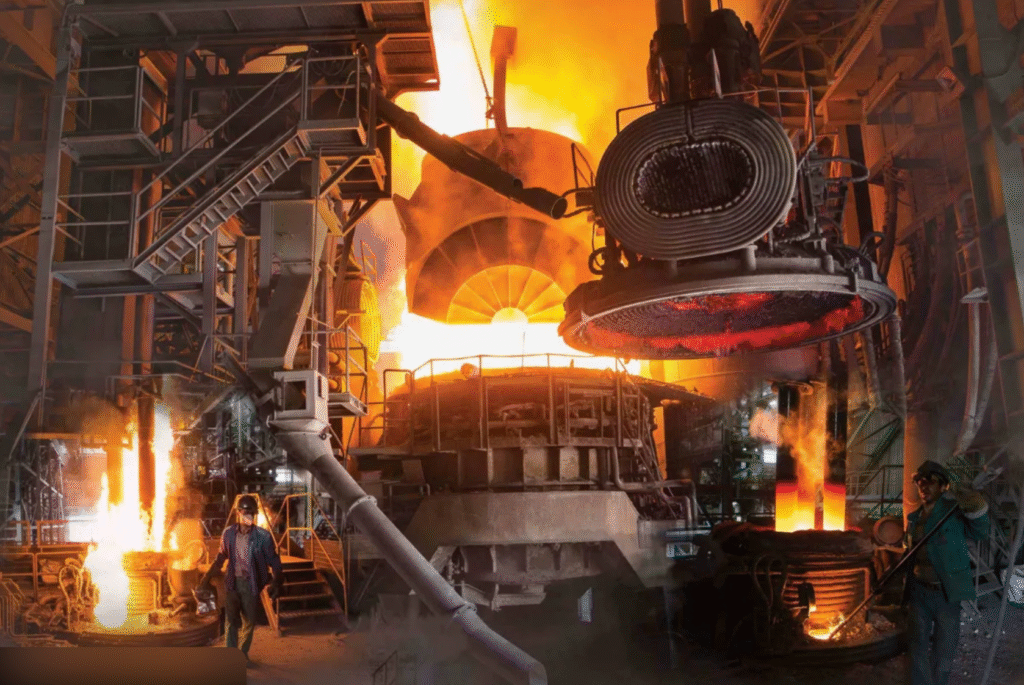

Picture source: Ripic