Using more scrap is strategically important because it directly improves costs, operational flexibility, and long-term sustainability in steel production.

- Scrap-based steelmaking reduces reliance on iron ore, coke, and other primary raw materials whose prices are increasingly volatile and exposed to geopolitical risk.

- It lowers overall energy intensity, shortens production chains, and improves responsiveness to demand fluctuations, particularly in EAF-based and hybrid operations.

- Higher scrap utilisation also supports circularity. Plants capable of absorbing higher scrap ratios are more adaptable to future regulatory, market, and technology shifts, making scrap use a structural competitiveness factor rather than a policy-driven response.

In this environment, scrap sourcing strategies can no longer be opportunistic or regionally narrow. They must be designed with a long-term view of supply security, carbon performance, and geopolitical resilience.

Understanding scrap markets before sourcing them

An effective scrap sourcing strategy starts with a clear understanding of scrap markets, not just in terms of price, but in terms of structure and evolution. This requires assessing scrap volumes, growth trajectories, collection systems, and the balance between industrial and post-consumer scrap across selected regions.

Regions such as MENA, other Africa, Turkey, Asia, and Latin America are increasingly relevant, both as emerging sources of scrap and as regions where collection, sorting, and processing infrastructure is still developing. Market assessments need to distinguish between scrap availability recognising that quality, contamination levels, and consistency matter as much as tonnage.

From market screening to supplier ecosystem mapping

Beyond country-level analysis, scrap sourcing depends on the structure of local supply ecosystems. In many regions, scrap flows through aggregators, traders, and semi-formal networks rather than directly from generators to steel producers.

Investigating and assessing scrap aggregators and providers becomes a core strategic task. This includes understanding the volumes and grades they can reliably supply, regulations, the types of clients they already serve, and their quality control and processing capabilities. It also requires evaluating different sourcing models, including closed-loop systems with industrial scrap generators, long-term offtake agreements, and structured agreements with aggregators or traders.

Each model carries different implications for control, flexibility, and risk, and no single approach is likely to be sufficient on its own.

In-depth supplier and risk assessment

In-depth assessment of shortlisted suppliers needs to address whether offered scrap qualities, specifications, and volumes are genuinely compatible with the buyer’s production routes and product mix.

This includes developing clear specification sheets for each usable scrap type, based on recognised standards such as the ReMA/ISRI, and validating whether suppliers can consistently meet those specifications at the volumes required.

Logistics also play a critical role. Shipping routes, port infrastructure, transit times, and cost volatility can materially affect delivered scrap economics, particularly for long-distance sourcing. Benchmarking suppliers against world-class best practices helps distinguish between similar suppliers with very different underlying capabilities.

Managing risk across the scrap value chain

Scrap sourcing carries risks that extend beyond individual suppliers. These include regulatory and export restrictions, environmental and social compliance issues, logistical bottlenecks, and exposure to price volatility and counterparty risk.

A comprehensive risk assessment, therefore, needs to cover the supply chain of potential suppliers. This assessment should identify where risks are concentrated and how risks can be mitigated through diversification, contractual structures, inventory strategies, or closer partnerships.

From sourcing to long-term partnership

Finally, a credible scrap sourcing strategy must translate into durable commercial arrangements. This means tailoring region and supplier-specific long-term supply contracts with selected suppliers. Long-term agreements are not simply about locking in price; they are about securing access, aligning incentives, and creating transparency over time. They also provide a platform for collaboration on quality improvements, traceability, and carbon performance.

How MM Markets Can Support

MM Markets supports companies in developing new scrap sourcing strategies depending on their needs.

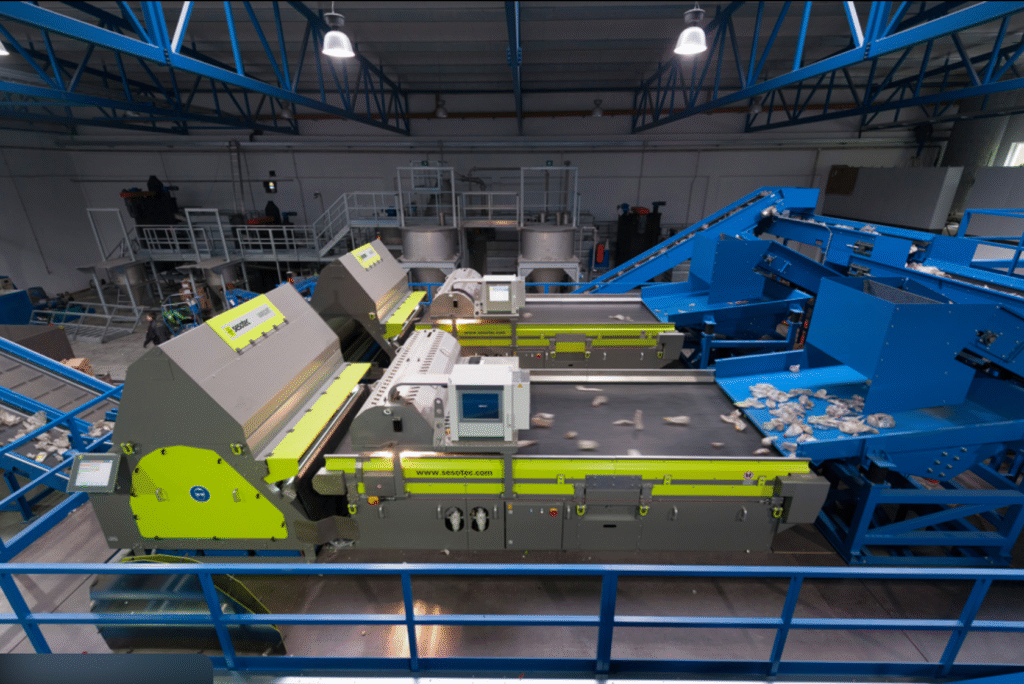

Picture: Sesotec