Data centres require large amounts of power to run servers, storage systems. Especially AI accelerators that operate continuously need strong cooling to remove the heat those machines generate. Unlike offices—where most energy is used by lighting, HVAC and intermittent equipment—data centres run high-density IT hardware 24/7, making both their electrical load and heat output far higher.

As a rough comparison, a typical data centre can use about ten to fifty times more power, including cooling (Source: US Department of Energy) than a conventional office building, depending on design and workload intensity.

Large datacentres need innovative cooling systems

Design innovation increasingly targets energy efficiency, leading to wider adoption of free cooling and, more recently, modern liquid and immersion cooling systems. These systems rely on copper-rich components—cold plates, manifolds and heat exchangers—while reducing or eliminating many conventional mechanical cooling elements such as chillers, CRAC units and large handlers.

Liquid and immersion cooling systems tend to increase copper use in the cold plates that sit directly on CPUs/GPUs, the coolant distribution manifolds and piping, and in liquid-to-liquid or liquid-to-air heat exchangers, where high thermal conductivity and corrosion resistance are critical. (Source: fabricant websites)

Aluminium and hybrid designs exist (e.g. copper tubes pressed into aluminium plates) with a reduced weight and cost, but most data-centres still favour all-copper components because aluminium and hybrid systems are still vulnerable to corrosion and therefore to downtime.

However, there is ongoing R&D aiming to create aluminium and aluminium-based composite components suitable for data-centre cooling.

More copper demand from upstream power-system expansion

Utility power used by data centres is expected to rise from 50.5 GW in 2024 to 61.8 GW in 2025, with an expected CAGR of 25% to 2030 (Source: S&P Global Research). This surge is already driving major investment in generation and grid infrastructure.

In the U.S., utilities estimate that data centres could consume up to 12% of national electricity by 2030, up from 4.4% in 2023 (Source: Lawrence Berkeley National Laboratory). PG&E alone plans approximately $73 billion of grid spending to support around 10 GW of new data-centre load in its territory in the US West.

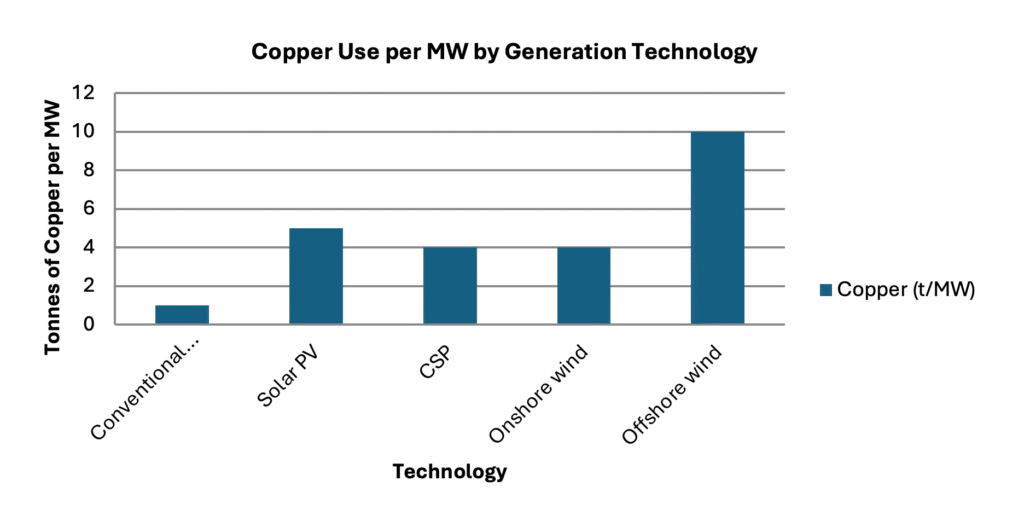

For copper markets, the implication is clear: the material footprint of data centres extends well upstream. New power plants—especially renewables—and the transmission and distribution networks required to supply this electricity are among the most copper-intensive assets in the energy system. As data-centre loads scale, so does the structural copper demand embedded in the generation fleet and grid required to power them.

Indicative copper intensity of power plants supplying data-centre loads (tonnes Cu per MW of capacity)

MM Market on data centres

Understanding these dynamics—construction trends, cooling technologies, upstream power-system effects and recycling flows—is essential for anticipating how AI-driven digital infrastructure will shape global copper and aluminium demand. We support clients across these areas with data-driven analysis, scenario modelling and market insight.