By 2025, roughly 78% of organisations globally report using AI in at least one function — up sharply from just over half only a few years ago. (Stanford University AI Index Report) The surge in AI adoption is driving one of the fastest construction cycles the tech sector has ever seen: the construction of data centres. In the United States, Census Bureau data for July 2025 show seasonally adjusted annual spending on data centre construction of around $45 billion—about 5–6% of all non-residential construction expanding at 32% CAGR since 2020.

The outlook is similarly strong. If announced projects move ahead, data-centre construction will continue to rise by around 19% CAGR within the next five years and reach around 12% of total U.S. non-residential activity in the coming years. Growth across the EU, China, Southeast Asia and Latin America is smaller in absolute terms but follows the same trajectory.

A major driver of copper and aluminium demand

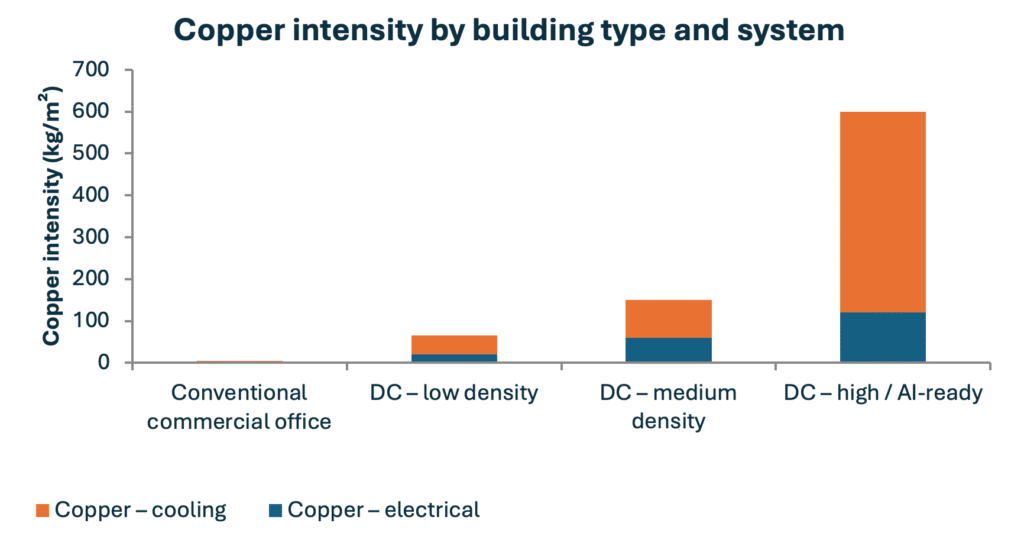

Data centres are among the most material-intensive buildings, with steel and copper—and aluminium—dominating their electrical and cooling systems. Case studies e.g. from Microsoft, Schneider Electric show that data-centre construction requires 60 – 600+ kg of copper per m², depending on power density. (Source: multiple studies including BHP, Banque de France, Copper Development Association, Bloomberg and Chicago Microsoft data centre case study). This order of magnitude is well above standard commercial buildings as datacentres use ca. 13-130 times more copper per m² than commercial buildings.

AI workloads use power-intensive GPUs packed tightly together, which means each rack needs far more power and cooling than traditional servers. This is what drives rack density up. As operators push toward higher densities to support AI workloads, the implications for copper and aluminium markets continue to be significant.

DC: Data Centres

Although Uninterruptible Power Supply (UPS) systems and backup infrastructure use other materials such as steel, lead, graphite, nickel, lithium and cobalt; data centres represent only a negligible fraction of global demand for these materials.

Copper—and, increasingly, aluminium in cooling systems—dominate the sector’s material footprint. These two metals remain the critical ones to monitor as capacity and power density rise.

MM Market on data centres

Understanding these dynamics—construction trends, cooling technologies, upstream power-system effects and recycling flows—is essential for anticipating how AI-driven digital infrastructure will shape global copper and aluminium demand. We support clients across these areas with data-driven analysis, scenario modelling and market insight.