Using scrap as feedstock for steel production has many advantages:

- Lower costs – Scrap steel is typically cheaper than iron ore and coking coal, the traditional inputs for BF-BOF steelmaking. In well-supplied markets like the EU and U.S., using more scrap can reduce input costs by 20–40% per tonne of steel.

- Lower energy use – Producing steel via the Electric Arc Furnace (EAF) route uses up to 70–75% less energy than ore-based methods.

- Lower emissions – The EAF route emits roughly 1 t CO₂e per tonne of steel, compared to 2.5 t CO₂e for ore-based routes. With mechanisms like carbon pricing, the EU CBAM, or U.S. IRA tax credits, these differences directly translate into financial advantages.

Why Are Scrap Ratios Still Low — and Why Do They Vary by Region?

- Technology lock-in – Scrap feedstock can only be fully utilized in EAFs, yet most of the world’s steel capacity still uses blast furnace–basic oxygen furnace (BF-BOF) technology designed for iron ore and coal.

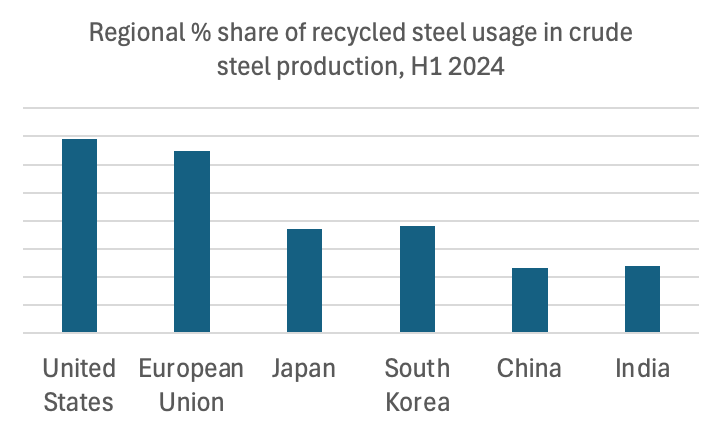

- Scrap availability – Many emerging economies (India, Southeast Asia, parts of Africa) have younger infrastructure and fewer end-of-life vehicles or buildings, meaning limited local scrap. This explains the low scrap ratios for China and India.

- Scrap quality and grade constraints – Steel made from scrap often contains residual elements such as copper, tin, and chromium, which can accumulate and make the steel brittle or difficult to weld. This is especially problematic for high-end grades such as automotive, electrical, or advanced high-strength steels, which require very low impurity levels. This quality constraint is a key factor behind the lower scrap ratios in Japan and South Korea.

Ultimately, the share of recycled steel in crude steel production reflects a complex balance of technology, resource availability, and market maturity. Regions like the U.S. and EU, with high EAF capacity, mature scrap markets, and supportive carbon policies, lead the way with recycled shares above 60%. In contrast, countries like Japan, Korea, China, and India face structural and metallurgical constraints that limit scrap integration. However, this gap is expected to narrow over the next decade.

As scrap collection improves, impurity-removal technologies advance, and low-carbon incentives expand, advanced steelmakers will progressively integrate higher levels of secondary feedstock.

For further information, please contact us. Until next time!